- #EXPENSE TRACKER EXCEL HOW TO#

- #EXPENSE TRACKER EXCEL PDF#

- #EXPENSE TRACKER EXCEL UPDATE#

- #EXPENSE TRACKER EXCEL PASSWORD#

- #EXPENSE TRACKER EXCEL DOWNLOAD#

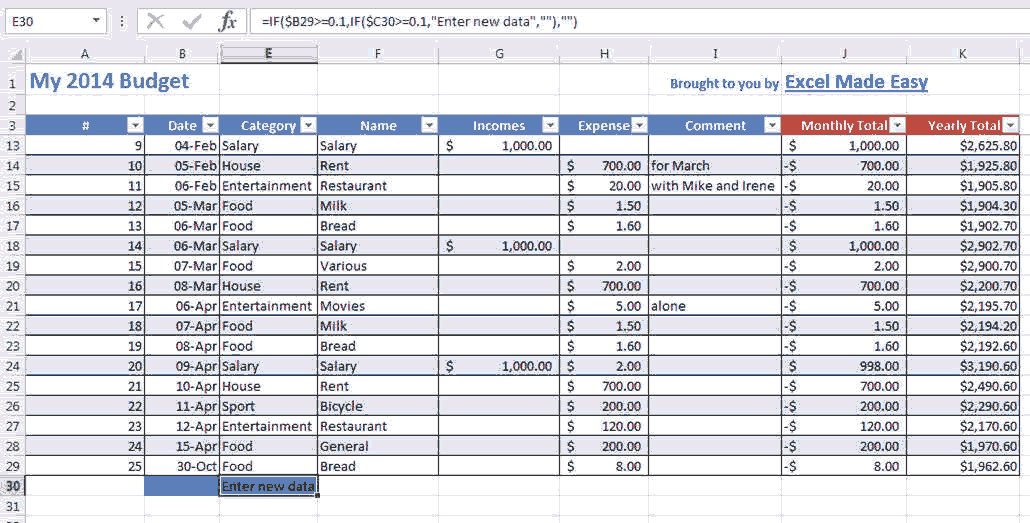

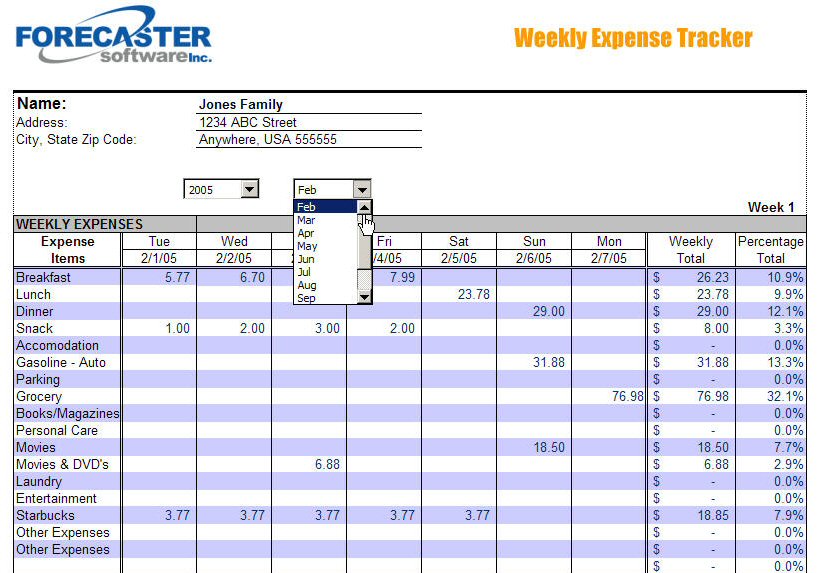

There is a Reconciliation page where you can perform a reconciliation for the month you are working in if the closing balance for the month does not match your bank account balance.These monthly worksheets are where the action happens! Here you will enter all your daily transactions of money received and money spent. You can rename them to suite the order of the months in your financial year.

The next 12 worksheets are months Month1 to Month12.These accounts are also known as Ledger Accounts and are found on the Chart of Accounts. In the AccountsHeaders you can rename the headers and account names to what you want to have in the template – so you can name five different streams of income, and 20 different expense types.The MonthsHeaders tab is where you enter the order that you require your months to be depending upon your financial year.

#EXPENSE TRACKER EXCEL HOW TO#

#EXPENSE TRACKER EXCEL DOWNLOAD#

When you first download and open the template, you might get an Excel message about automatic updating of external links - it is these links Excel refers to - it is safe to Enable the Content.

#EXPENSE TRACKER EXCEL UPDATE#

You must manually update the data source worksheet to include these new rows. When you insert extra rows into each month because you have more transactions than the available rows in the template, the data source does not automatically update with these new rows.

#EXPENSE TRACKER EXCEL PDF#

Here are printable PDF instructions for updating the sales tax report : This Accounting Excel Template is just like a cashbook and the money received and money spent transactions should be a reflection of what happens on your bank account.

#EXPENSE TRACKER EXCEL PASSWORD#

You must manually unhide the Sales Tax Data sheet (there is no password to unhide it), insert the number of new rows required in the correct month, and enter the formulas (copy from ones already in there) into those rows to pick up data from the monthly tabs. Note: if you insert new rows into the monthly tabs, the sales tax report will not be accurate because the source data has not been set up to include new rows. Three Open the accounting excel template and save it by going into ‘File’, ‘Save Copy’ or 'Save As' in Excel and give it a name of your choice and save it to your digital filing system.

Go and check that folder to access the downloaded template. Two Once you click on the button the template will automatically download into the Downloads folder on your device.

This can be customized to use with any financial year-end. One To download the template, select (click-on) the blue button. If you want a template without sales tax you can try my Excel Cash Book for easy bookkeeping.

0 kommentar(er)

0 kommentar(er)